refinance transfer taxes new york

Article 31 of the New York State Tax Law imposes a real estate transfer tax the State Transfer Tax on each conveyance of real property or interest in real property if the consideration exceeds 500 with the tax being computed at the rate of 2 for each 500 of consideration or a fractional part thereof NY. Yet they may end up doing so if their lenders dont cooperate.

Pin By Dee Dee On Money Learning Words Word Search Puzzle

Tax Law 1402 a.

. 1 to 3 of purchase price if applicable. The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. You must also pay RPTT for the sale or transfer of at least 50 of ownership in a corporation partnership trust or other entity that ownsleases property and.

5 rows New York State also applies a 04 transfer tax on all properties. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell.

Administrative fee for nondeed transfers. The New York State transfer tax rate is currently 04 of the sales price of a home. Your Present Mortgage Rate.

For homes with sales prices over 500000 the tax is 1425. Monthly Difference in Payment at 8. What is the real estate transfer tax rate in New York.

An additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metropolitan Commuter Transportation District. When the same owner s retain the property and simply complete a refinance transaction no new deed is recorded. 13th Sep 2010 0328 am.

Monthly Payment at 8. If a purchase CEMA is used the seller will only pay the NYS transfer tax on the price less than the amount of the mortgage transferred. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

Additional fees Associated with a CEMA. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak. New York State also has a mansion tax.

8 hours agoThe average interest rate on the 15-year fixed refinance mortgage stayed at 452. The recording of a mortgage is subject to. Pickup or payoff fee.

A transfer tax is a seller closing cost levied on the transfer of real property in New York City. Both NYC and New York State charge separate transfer taxes on sellers. You can make sure the seller understands that they will likewise be saving for them as well because they will have reduced New York State transfer taxes which are typically 04 of the sale price.

Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. If either one does not accept the process must be paid.

That is usually the easiest way to not pay the tax. If you live in New York and want to refinance a mortgage on your property you may take advantage of a special type of loan a Consolidation Extension and Modification Agreement CEMAA CEMA allows you to only pay mortgage recording tax on the difference between your original mortgage and the refinance rather than the entirety of the new loanwhich can result. Under the law prior to July 1 2021 where the grantee paid the NYS transfer tax the amount of the transfer tax paid by the grantee would be included in the taxable consideration and the NYS transfer tax would be grossed up accordingly.

The New York City transfer tax sits at 1 of the sales price for homes worth 500000 or less. Last week the 15-year fixed-rate mortgage was at 429. New York State equalization fee.

Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. Annual Difference in Payment at 8. You will also be subject to New York State transfer taxes which is 04 of the sales price for properties below 3 million and 065 for properties over 3 million.

Basic tax of 50 cents per 100 of mortgage debt or obligation secured. In New York State the transfer tax is calculated at a rate of two dollars for every 500. New York State transfer tax.

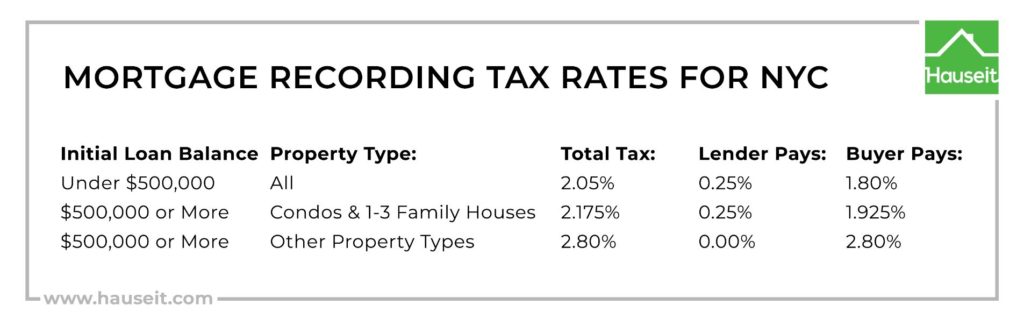

Additionally in 2019 NYS. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays 025 of the MRT.

Article 31 of the New York State Tax Law imposes a real estate transfer tax the State Transfer Tax on each conveyance of real property or interest in real property if the consideration exceeds 500 with the tax being computed at the rate of 2 for each 500 of consideration or a fractional part thereof NY. In New York State the transfer tax is calculated at a rate of two dollars for every 500For instance the real estate transfer tax would come to 1200 for a 300000 home. Remember however that the actual amount you may save by refinancing depends on many factors such as your tax bracket and how long you plan to remain in your home.

You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City. Potential fees for co-ops. Perhaps the best bet is refinance with the existing lender.

If you are buying residential property and you plan to make it your primary residence you may be entitled to school tax relief through the New York State STAR credit. Under the revised law if the conveyance is of residential real property and the grantee pays the NYS transfer tax the NYS transfer tax is no. Transfer tax on refinance in new york.

Therefore the effective Mortgage Recording Tax rates you pay as a buyer in NYC are 18 for loans under 500k and 1925 for loans of 500k or more. Transfer taxes are one of the largest closing costs for NYC sellers after the typical 6 NYC broker fee. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST.

The Best Tax Software To File Your 2021 Taxes

Spirit Of Texas Bank Online Banking Login Online Banking Banking Bank

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Transfer Of Ownership And Title Of Property In Ontario

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Real Estate Transfer Taxes In New York Smartasset

Saving On Mortgage Taxes Mortgages The New York Times

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Mortgage Calculator Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Ni Mortgage Calculator Online Mortgage Mortgage

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Refinancing Your House How A Cema Mortgage Can Help

First Volunteer Bank Login Guide For Online Banking Online Banking Banking Services Banking

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Reducing Refinancing Expenses The New York Times

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo